idaho inheritance tax rate

By contrast an inheritance tax is paid by the heir or heirs of a decedents assets. For more details on Idaho estate tax requirements for deaths before Jan.

State By State Estate And Inheritance Tax Rates Everplans

Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

. For 2022 homeowners age 65 or older with income of 32230 or less are eligible for a. The table below shows tax rates and brackets for. This means that Idaho taxes higher earnings at a higher.

The gift tax exemption mirrors the estate tax exemption. The corporate tax rate is now 6. Individual income tax is graduated.

For more information see what are Idahos sales tax rate and our Use Tax brochure. Differences Between Inheritance and Estate Taxes. Your average tax rate is 1198 and your marginal tax rate is 22.

Idaho has reduced its income tax rates. Idaho doesnt have an estate tax. Idaho has no inheritance tax or gift tax.

Also gifts of 15000 and below do not. Idahos capital gains deduction. For individual income tax the rates range from 1 to 6 and the number of.

Taxidahogovindrate For years. Technically there are 2 cases when an Idaho resident will become responsible for the tax due when they inherit. In Idaho the median property tax rate is 659 per 100000 of assessed home value.

Inheritance taxes for Idaho residents. If you make 70000 a year living in the region of Idaho USA you will be taxed 12366. Idaho does not levy an estate tax although.

Marginal rates begin at 100 and reach 650 for earners in the top bracket. The table below summarizes the estate tax rates for Idaho and. Lower tax rates tax rebate.

And although the Federal Gift Tax applies to all US citizens it has an annual exclusion rate of 16000 per recipient. 1 2005 contact us in the. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon your taxable income the first two. There are five income tax brackets in Idaho. As of 2004 the state of Idaho expired its estate and inheritance taxes.

Income tax rates for 2021 range from 1 to 65 on Idaho taxable income. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Personal income tax rates in Idaho are based on your income and filing status.

Idaho state tax rates Idaho state income tax rate. One important thing to know about Idaho. Idaho Income Tax Calculator 2021.

The US does not impose an inheritance tax but it does impose a gift tax. Click the nifty map below to find the current rates. If the total value of the estate falls below the exemption line then there is no.

In other words the estate itself can be taxed for the amount that is above the exemption cut-off. Idaho state sales tax rate. In Idaho income tax rates range from 1 to 65 percent.

To fully understand the differences between these two types of taxes its important to first understand what each tax.

Idaho Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

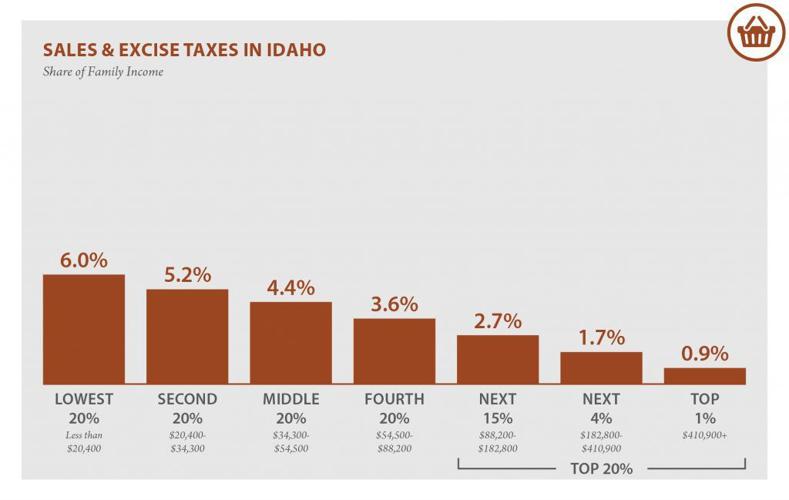

Economic Study Finds That Poor Idahoans Pay More State And Local Taxes Than Rich Ones Local News Idahopress Com

State Estate And Inheritance Taxes Itep

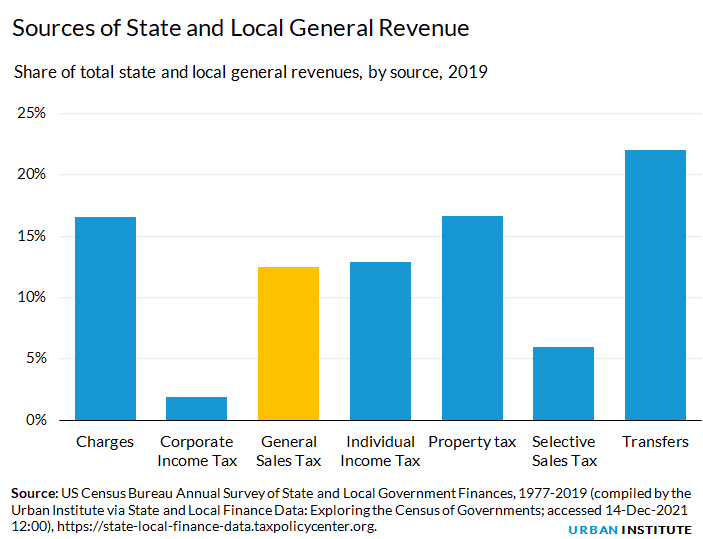

General Sales Taxes And Gross Receipts Taxes Urban Institute

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

State Tax Levels In The United States Wikiwand

Idaho State Tax Guide Kiplinger

Historical Idaho Tax Policy Information Ballotpedia

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

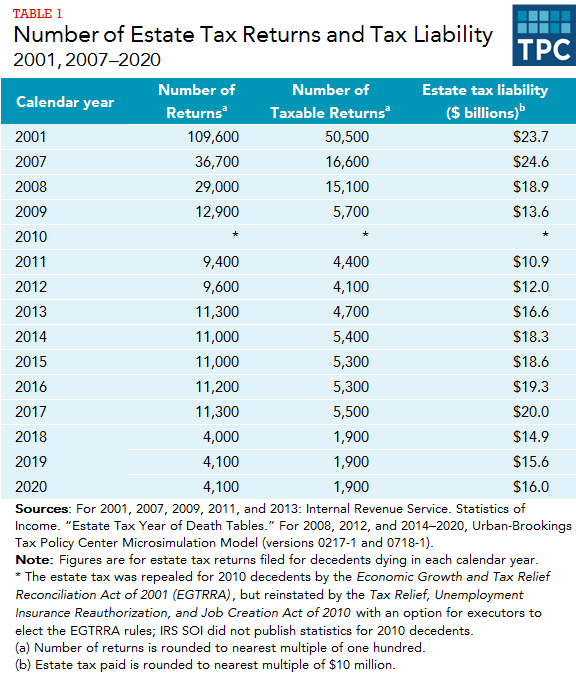

Pdf The Federal Estate Tax History Law And Economics Semantic Scholar

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

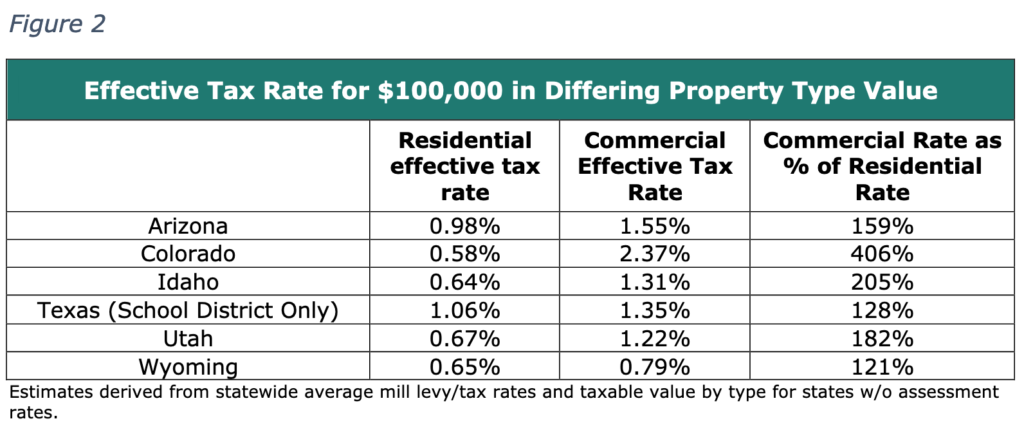

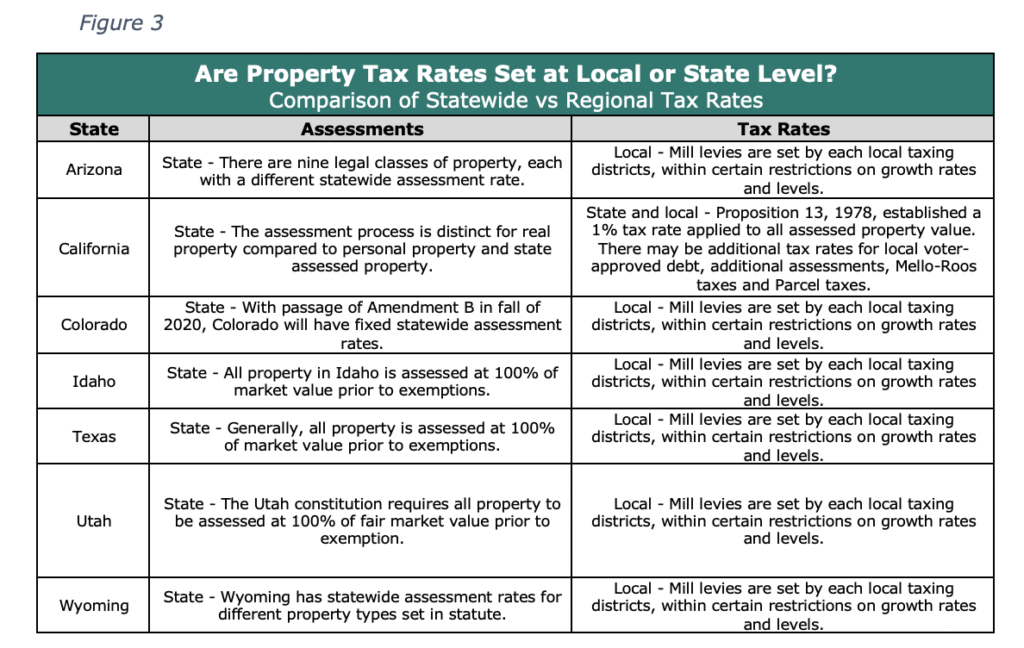

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

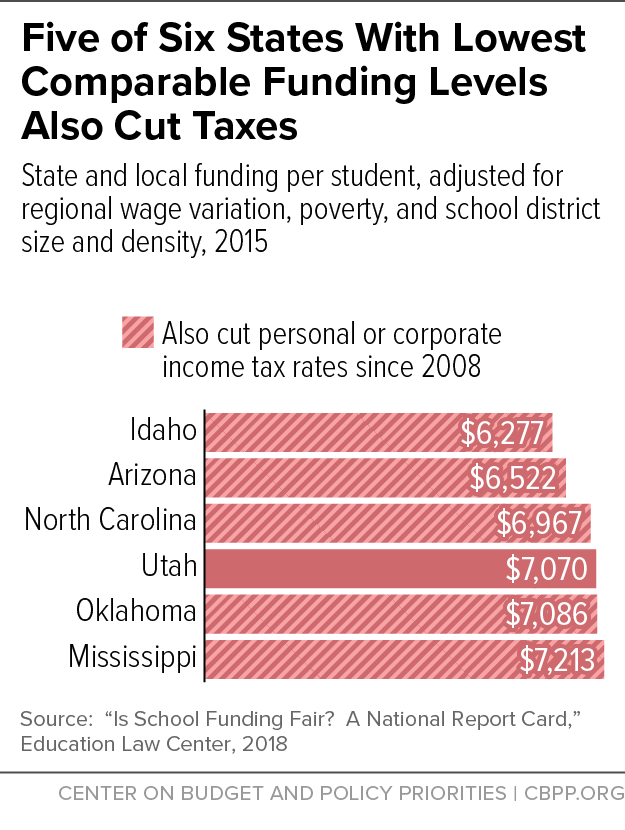

North Carolina S Deep Tax Cuts Impeding Adequate School Funding Center On Budget And Policy Priorities

State Estate And Inheritance Taxes Itep

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate