portability estate tax return

Specifically under Section 401 1 of Rev. Portability is the right of an executor to transfer or port the unused estate tax exemption from the first spouse to die to the second spouse to die.

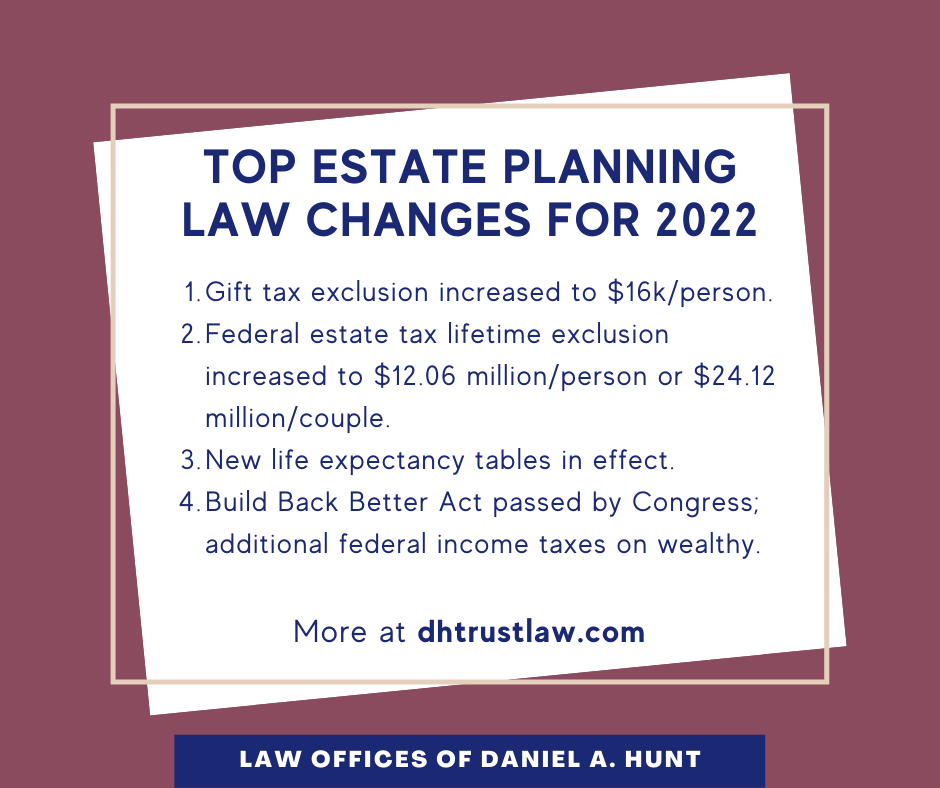

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

2010c5A to allow the surviving spouse to take into account the decedents deceased spousal unused exclusion DSUE amount.

. Thanks to portability the surviving spouse can use the deceased spouses unused estate tax exemption and add it to their own when the surviving spouse passes away. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. Scenario 1 File a return and elect portability.

Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such return. In addition going forward any executor will automatically have until the second. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death.

Since Bob died in 2019 his lifetime exemption is 114 million. His gross estate is 84 million 50 of 168 million. Estate tax return preparers who prepare a return or claim for refund which reflects.

A Bit of Background. To use the DSUE the estate must timely file an Estate Tax Return when the first spouse passes away and the portability election must also be properly completed. The Estate Tax Portability Feature is Now Permanent Should You File Form 706 Even If It Is Not Required.

The Impact of the Portability of the Federal Estate Tax Exclusion Example 1. It is transferred to the surviving spouse to reduce the overall estate tax once the second spouse passes away. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can make the right decision of whether or not to make.

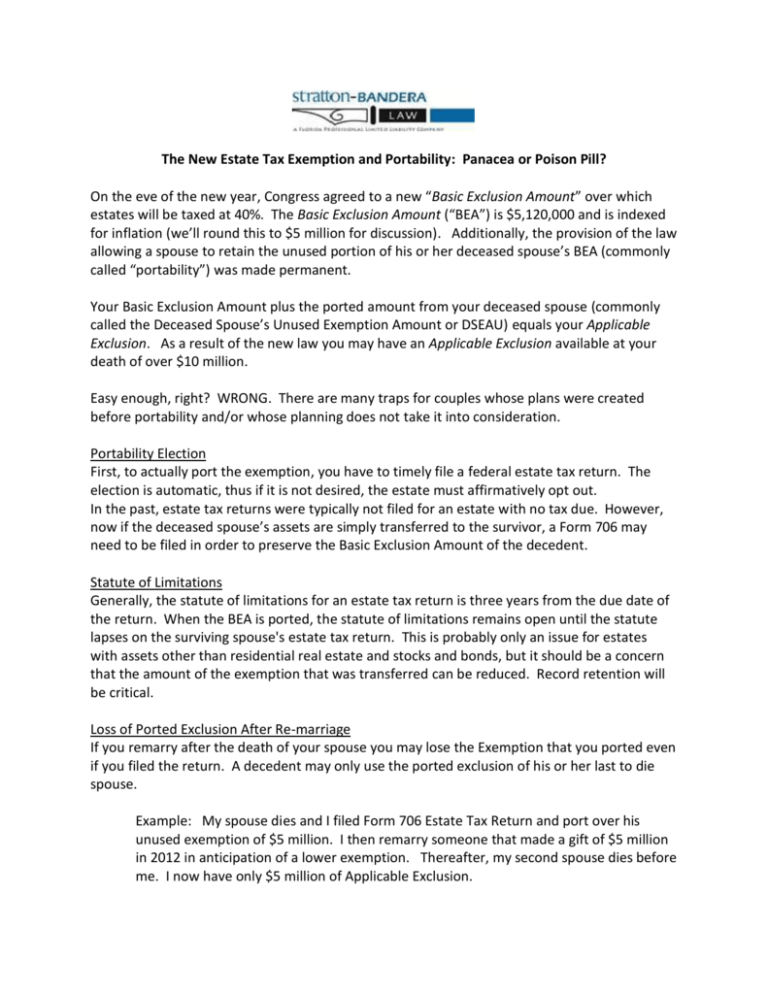

One of the biggest developments in the estate and gift tax field to come out of the recent tax act American Taxpayer Relief Tax Act Of 2012 is the permanence of the so-called portability provisions first established in 2010. The filing of a Federal estate tax return will nonetheless be required in order to make a portability election. An estate tax return is not required.

To secure these benefits however the deceased spouses. Another concept needs to be understood as well portability. According to the representation based on the value of Decedents gross estate it isnt required to file an estate tax return Form 706 United States.

From the IRS. Where the gross estate does not exceed the basic exclusion amount and filing a Federal estate tax return is only required for the purpose of making the portability election additional extension relief may be applied for under applicable regulations. This is called the deceased spouses unused exemption or DSUE.

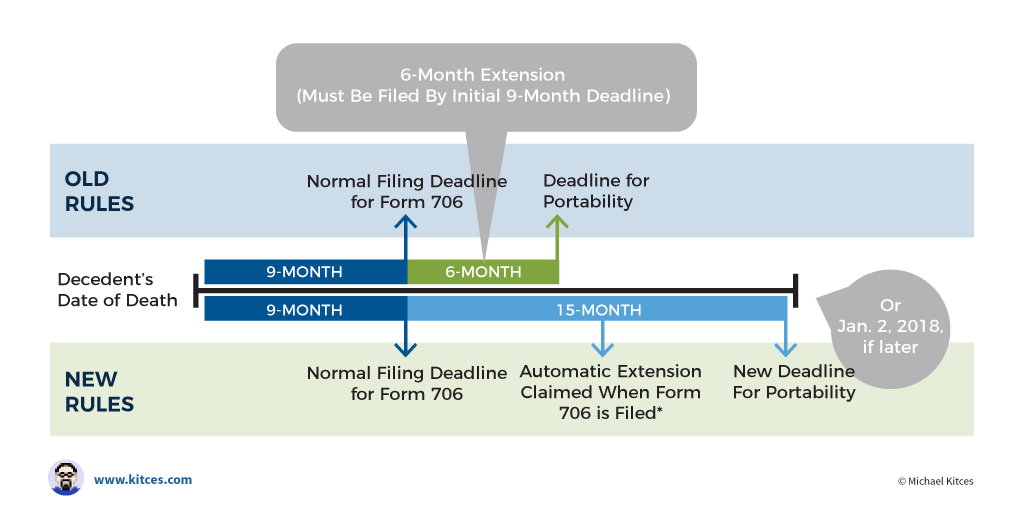

However Clara must choose whether or not to file a timely estate tax return to elect portability. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months. These steps could be easily overlooked since an Estate Tax Return does not necessarily have to be filed if the estate is below the exemption amount.

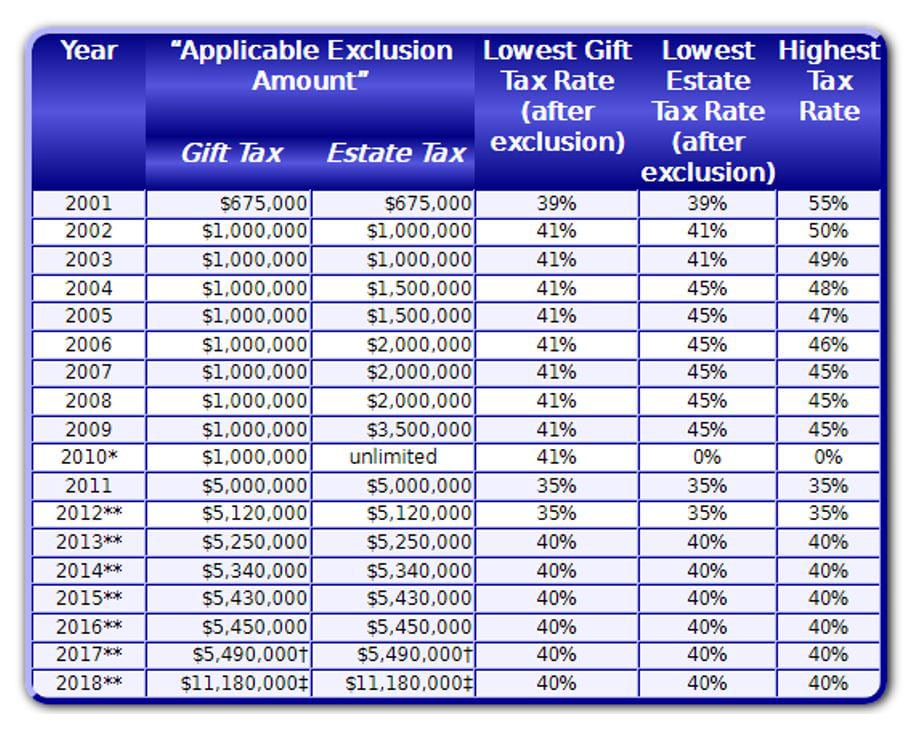

This portability election increases the total exclusion available to the surviving spouse by the amount of the deceased spouses unused exclusion. An estate received extra time to make a portability election under IRC. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the.

Portability is a federal exemption. The due date of the estate tax return is nine months after the decedents date of death however the. Portability is the term used to describe a relatively new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his or her deceased spouse to shelter assets from gift tax during the surviving spouses life andor estate tax at the surviving spouses death.

What Does Portability of the Estate Tax Exemption Mean. 2017-34 any estate of a decedent who passed away after December 31st of 2010 is automatically granted an extension until January 2nd of 2018 to file the Form 706 estate tax return to claim portability. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of.

If you dont file the 706 at the first death you cannot elect to port over this remaining amount. The temporary portability regulations require every estate electing portability to file an estate tax return within nine 9 months of the decedents date of death unless an extension of time for. In October the IRS posted Form 706 United States Estate and Generation-Skipping Transfer Tax Return and its final instructionsThe instructions provide guidance for electing the portability of a deceased spouses unused estate and gift tax exclusion amount and for the executors use of the check box to opt out of electing portability of the.

In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. A portability election made by a non-appointed executor when there is no appointed executor for that decedents estate can be superseded by a subsequent contrary election made by an appointed executor of that same decedents estate on an estate tax return filed on or before the due date of the return including extensions actually granted.

For 2020 the exemption amount is 1158 million and the IRS just announced that that amount will increase to 117 million for 2021.

A New Era In Death And Estate Taxes

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax Introduction Video Taxes Khan Academy

Understanding Qualified Domestic Trusts And Portability

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Will My Executor Be Required To File An Estate Tax Return Vermillion Law Firm Llc Dallas Estate Planning Attorneys

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Form 706 Extension For Portability Under Rev Proc 2017 34

The New Estate Tax Exemption And Portability Panacea Or Poison

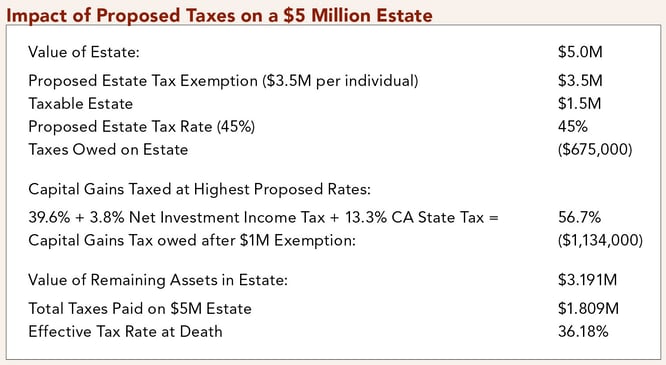

Tax Related Estate Planning Lee Kiefer Park

Exploring The Estate Tax Part 2 Journal Of Accountancy

Locking In A Deceased Spouse S Unused Federal Estate Tax Exemption

Is My Estate Subject To Tax Udall Shumway Law Firm Phoenix Az

File Form 706 Federal Estate Tax Return By Patti Spencer Estategenie Blog

2013 Gift Estate Planning Opportunities

Estate Tax Portability Preserving It For The Benefit Of Your Heirs